Such quantity showcase the new measurable great things about pattern-following the steps whenever paired with self-disciplined risk management. Automatic exchange isn’t foolproof, nonetheless it’s a strong friend inside the today’s punctual-moving areas. It’s wise to begin quick, very first exchange that have a limited quantity of financing to minimize prospective losses. As you acquire sense and you can rely on on your own method, you could potentially slowly scale-up. Is even crucial — having fun with stop-loss orders and you will function restrictions for the reputation versions can safeguard against extreme loss, especially in erratic segments.

How Arbitrage Works

- By the performing comprehensive look, backtesting, and implementing self-disciplined exposure administration, buyers is also utilize the chance of algorithmic trade to compliment their steps and you will acquire an edge in the progressive financing.

- But right here’s in which you should be creative and acquire the newest deceive which may generate income to you personally.

- Such as detection due to algorithms will assist industry founder pick highest order options and permit these to work for from the filling up the fresh sales during the a top rate.

- Which issue is not and should not end up being construed since the an enthusiastic offer to shop for or sell any protection.

Another potential issue with algorithmic trade ‘s the danger of undertaking an excessive amount of, or undertaking regulations which can be also complex, both named more than-optimization. Whenever developing trade algorithms, it can be appealing to help you okay-track the new parameters to undertake exceptional efficiency to your historic analysis. Yet not, this leads to bend-fitting and strategies one to perform badly inside genuine-day field criteria.

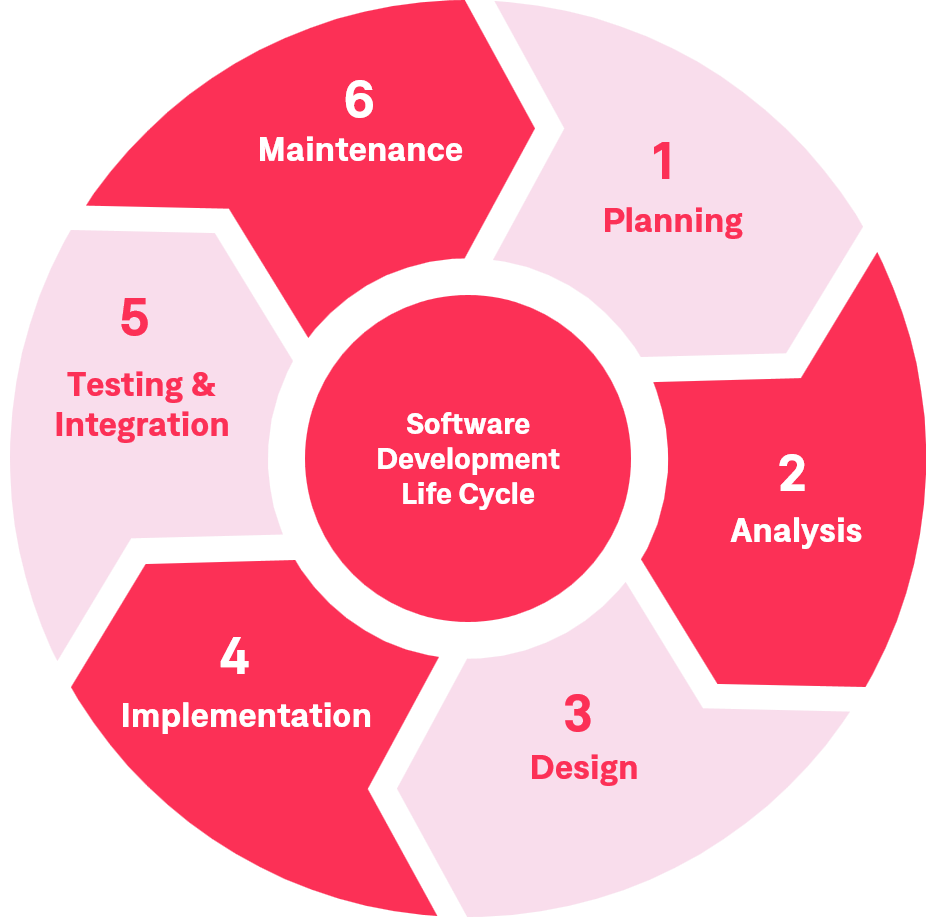

Inside, the techniques is checked out playing with historic investigation understand how well the new reason https://nhasach.nhathothaiha.net/2025/05/15/what-is-actually-report-change-meaning-and-methods/ could have spent some time working for many who made use of it on the previous. In addition to, with regards to the results you have made the chance to optimise the fresh strategy and its own parameters. Historically, guide exchange was previously common, in which, the brand new trader had to assemble the information yourself and place the transaction telephonically on the execution of one’s trade. That would involve a lot of time and effort so because of this, perhaps not make a lot of efficiency since the not much of change you are going to result.

Timeframe-Specific Techniques

For additional information regarding the cost to the margin money, please discover Margin Loan Costs. Merging VPA with the symptoms can help buyers refine the signals and you may boost entryway timing. A highly-customized technology options might also want to tend to be robust security to manage the brand new uncertainty and you will quick transform as much as development occurrences.

Servers learning models get acquainted with historical research to help you anticipate rates movements. They’re able to deal with unstructured research, such as social network belief otherwise reports headlines, providing people an edge. In the crypto areas, in which buzz to your networks including X can also be surge cost, AI’s capacity to processes genuine-time chatter are a game title-changer. Possibilities can be procedure vast amounts of analysis—rate feeds, information, volume—in real time. It performance minimizes “slippage,” in which prices alter anywhere between choosing to change and the change happening.

Common Automatic Trade Steps

Anyway, higher servings out of the present stock exchange count close to it unit. Algorithmic change has been proven to help you significantly raise field liquidity99 among almost every other professionals. However, advancements in the output introduced from the algorithmic exchange was compared from the individual brokers and you may buyers up against strong battle of machines.

What’s the best AI bot to own crypto change within the 2025?

Grid exchange now offers a structured treatment for cash inside the unstable places because of the establishing automated purchases from the set price levels. It requires benefit of each other upward and you may down price moves instead of needing to anticipate field direction. If a money surges far above the regular diversity, the device sells, expecting a decrease. It’s effective in secure segments however, risky throughout the good trend, where rates can be stay “extreme” more than expected. Designers manage these algorithms using coding dialects for example Python otherwise C++.

Essentially, the technique of front side-powering is deemed illegal with regards to the items which is greatly managed by the Financial Globe Regulatory Power (FINRA). Before the trading purchase are completely filled, that it algorithm continues sending partial requests with respect to the defined participation proportion and you can with regards to the frequency exchanged regarding the areas. The newest associated “actions approach” delivers purchases during the a person-defined part of field quantities and you may increases otherwise decrease so it participation speed if inventory price has reached affiliate-defined profile.